Dynamic FCU Cards Are Being Upgraded

We’re upgrading Debit, Credit, and Health Savings cards. Card upgrade date: November 10, 2025.

Your new card will arrive by mail

during October, before the upgrade.

Please keep using your current card until November

10, 2025. The new card will not work before that date.

What to Expect

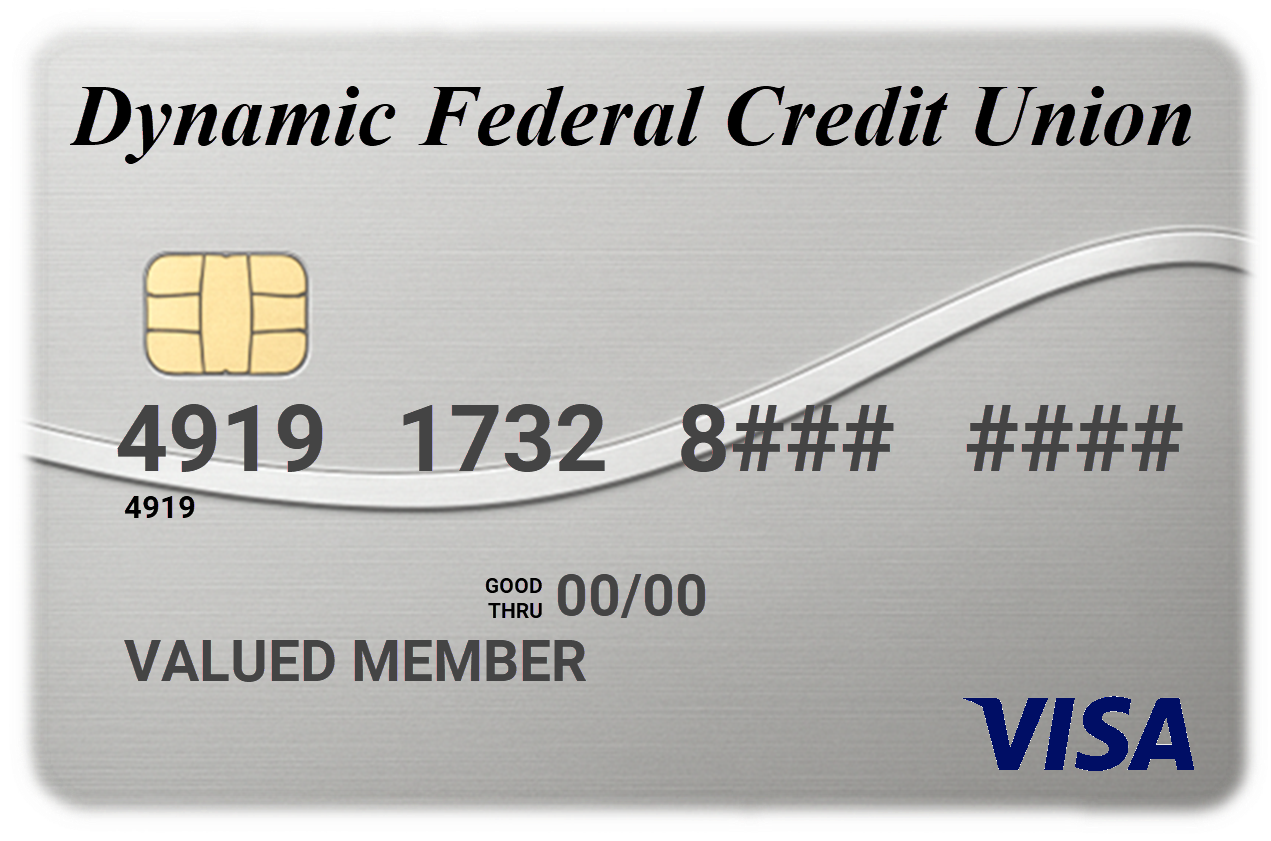

Updated card design

Fresh look across Debit, HSA, and Credit cards featuring our updated name with the same security you trust.

Tap to Pay

Faster checkout with contactless just tap where you see the symbol. No inserting or swiping, which reduces wear and keeps your card’s chip cleaner.

Manage your card

Enhanced controls in Online Banking & the Mobile App: balance & spending alerts, travel plans, and activate/deactivate controls.

Live credit card details

View balances and transactions right in Online Banking & the Mobile App no separate EZCard login.

Enhanced Credit Card Rewards

Cash back, points, discounted travel, and more with our Enhanced Rewards Program. Learn more

Mobile wallets in

2026

Support planned for Apple Pay, Google Pay, Samsung Pay, Garmin Pay, and Amazon One.

Activation date

New cards become active on November 10, 2025 (activate on or after this date).

Card delivery

Replacement cards will arrive by mail

during October.

New Automatic Payment Enhancement Our system can now process automatic credit card auto‑payments via ACH from external financial institutions. If you currently use EZCard to manage automatic payments, you must update your setup with us to ensure payments continue after the November 10, 2025 upgrade.

Automatic payment methods set up within EZCard will stop after November 7, 2025. To plan ahead, please complete our automatic payment form we’ll use it to configure your autopay correctly after November 10, 2025.

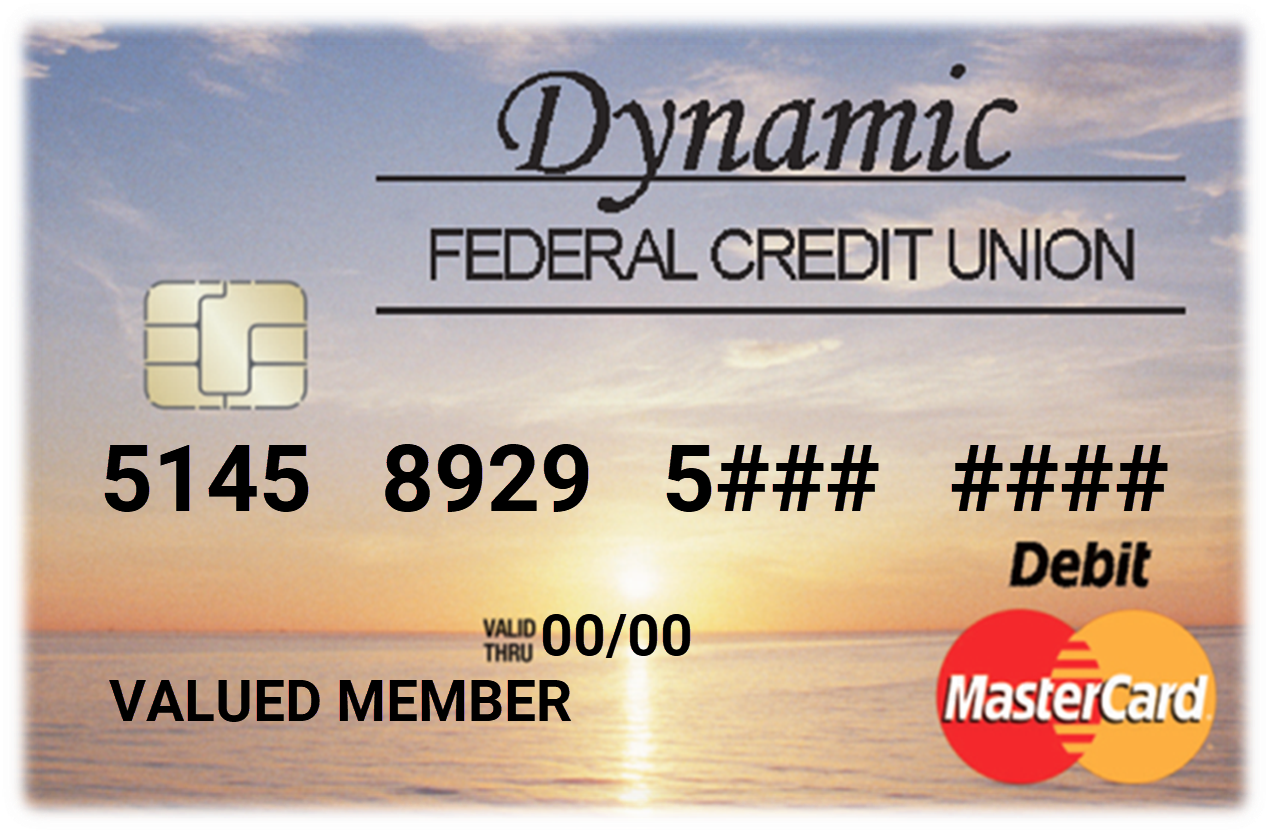

How to tell which card is which

Card Type

Design (Current)

Design (New)

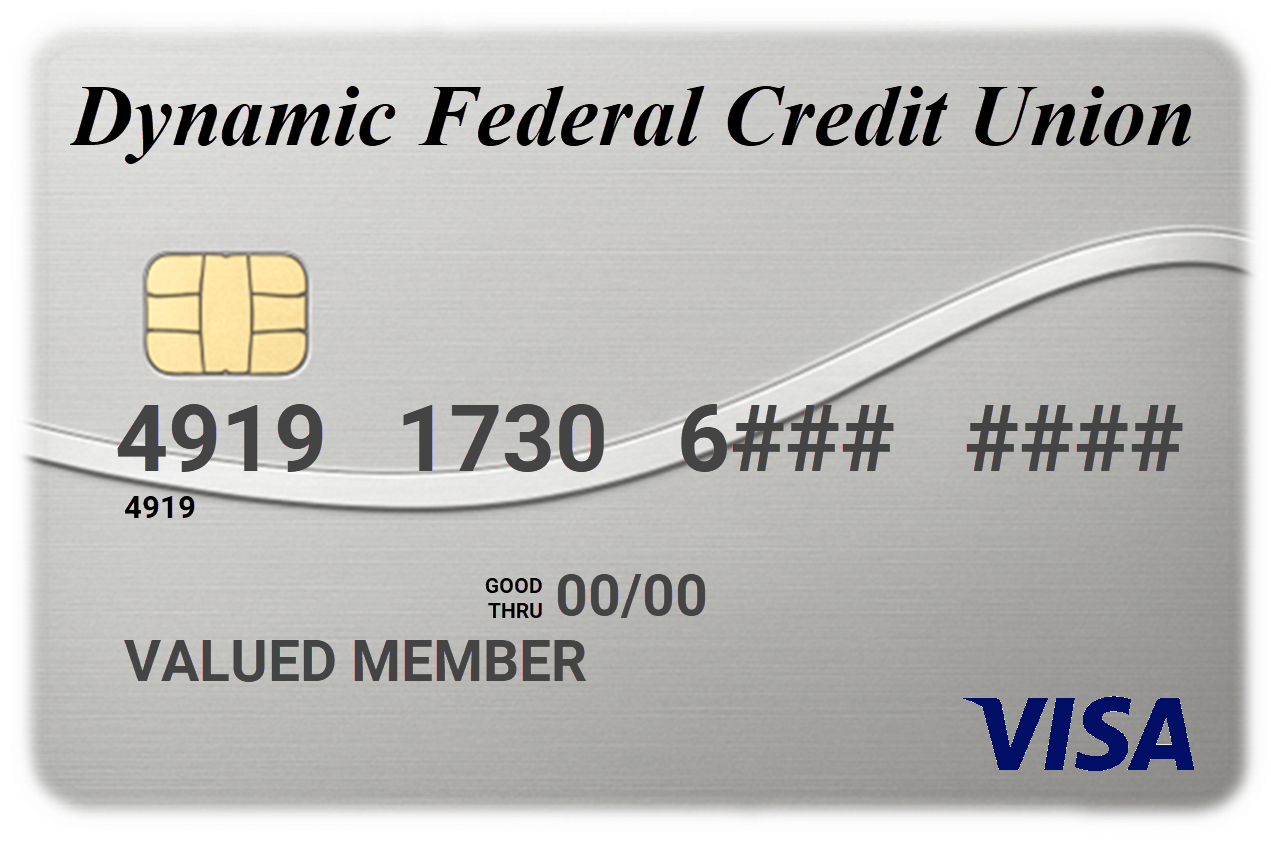

Debit Card

Replacement required on or after November

10, 2025. Current design:

Sunset.

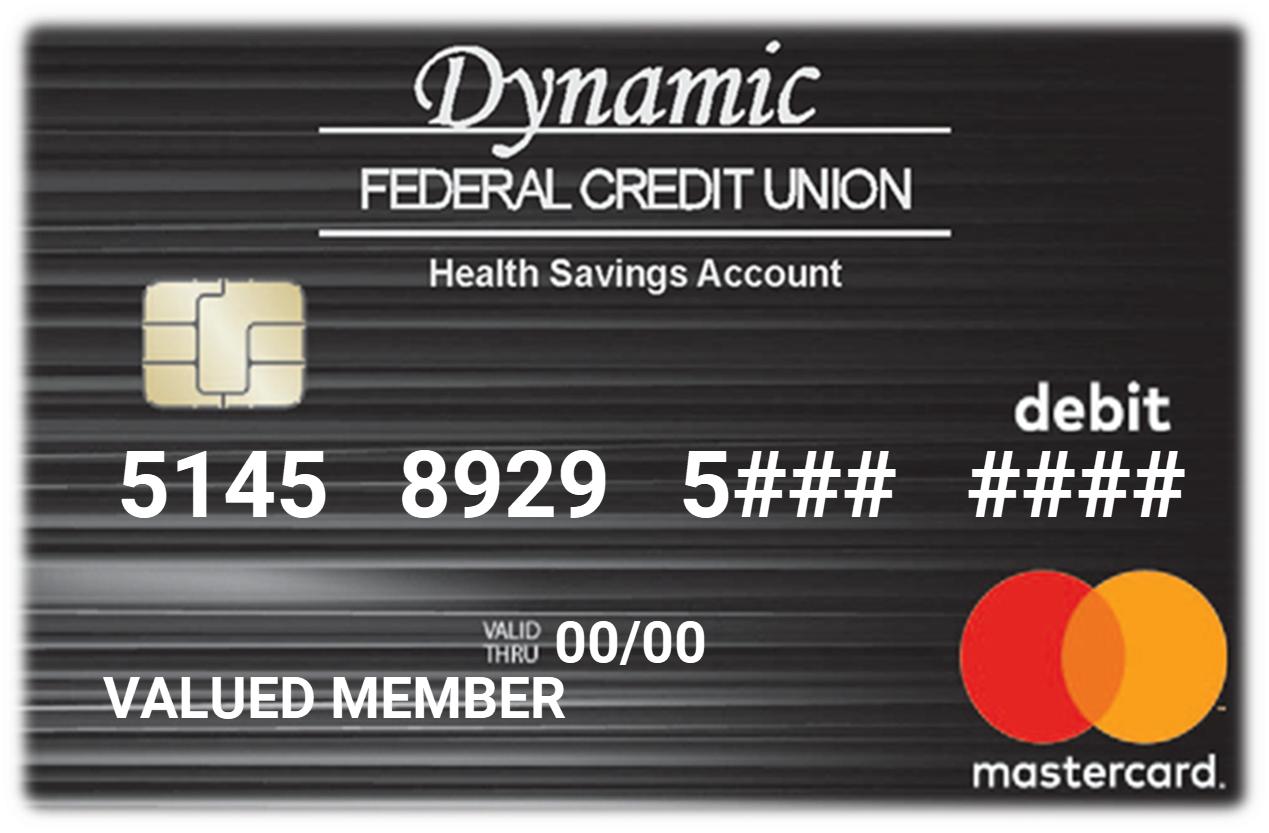

Health Savings Debit Card

Replacement required on or after November

10, 2025. Current design: Black.

Credit Classic Card

Replacement required on or after

November

10, 2025. Current design:

Silver.

Credit Platinum Rewards Card

Replacement required on or after

November

10, 2025. Current design: Silver. Rewards balance carries over to the Enhanced Rewards Program.

Credit Business Card

No current card (Business Credit Card launches with this upgrade). If your business uses our credit card today, you’ll be enrolled. Restrictions apply contact your loan officer for details.

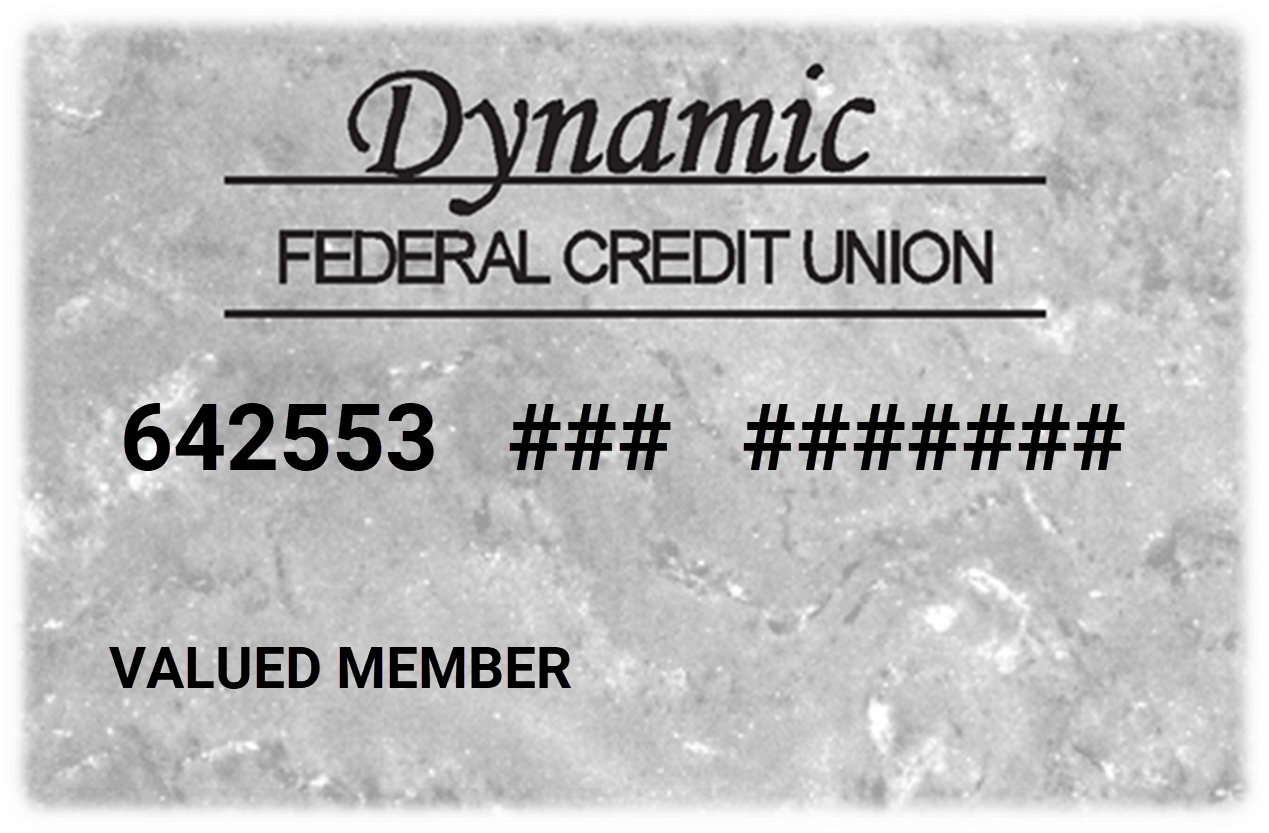

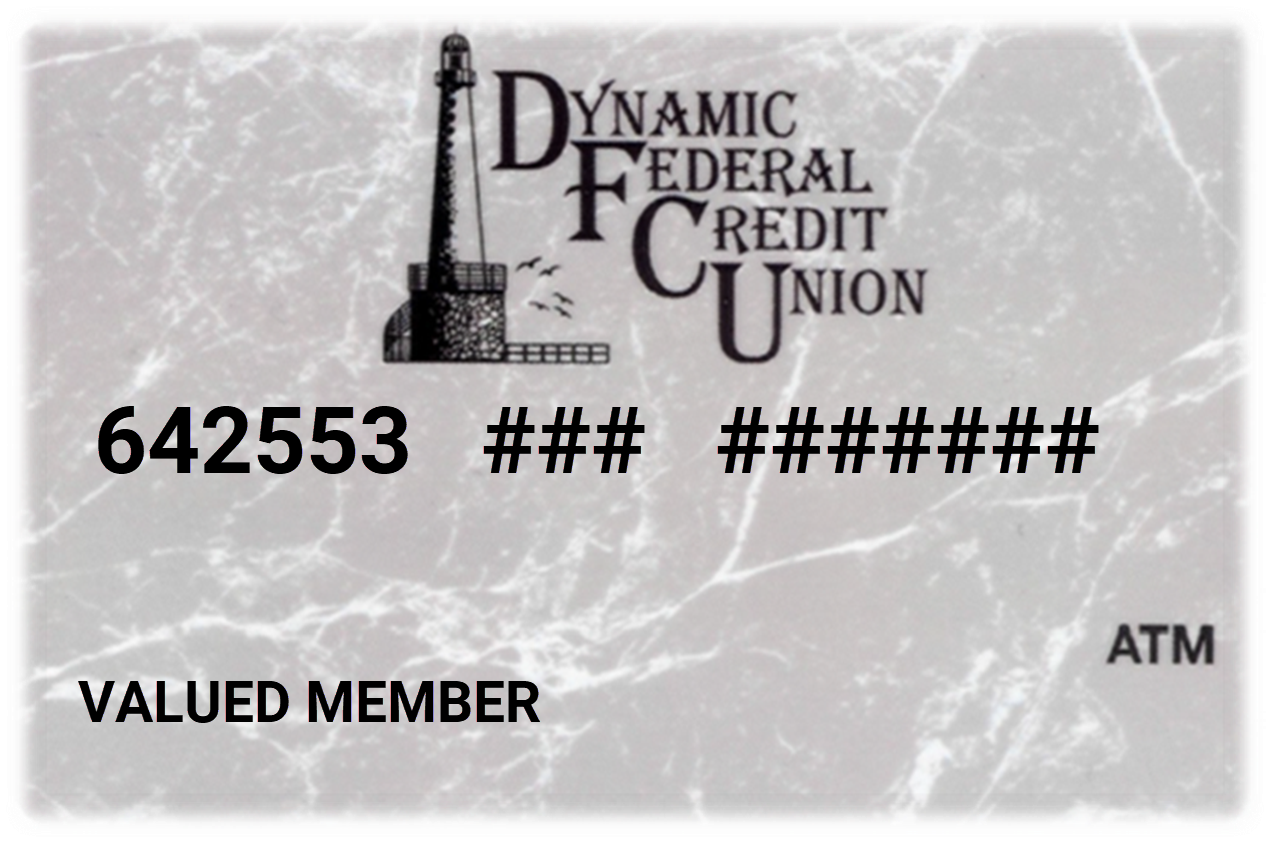

ATM Card

Note: We are not updating ATM-only cards at this time. Existing ATM cards will continue working after

November

9, 2025.

Action Required by Members

- By September 30, 2025: Confirm your contact information (mailing address, home phone, cell phone, email) with Dynamic FCU so your card arrives correctly in October.

- Before November 10, 2025: Keep your contact info current; watch your mail for the new card; continue using your current card until November 10.

- If you will be out of state during October or November, contact us so we can advise you on maintaining access.

- Plan ahead for the upgrade window (November 7, 6:00 PM – November 10, 3:00 AM): complete essential purchases before 6:00 PM (ET) on November 7, consider an alternate payment method, and keep track of your transactions. Review balances before the Online Banking & Mobile App blackout period.

- On or after November 10, 2025: Call the Card Activation Hotline at (419) 586‑5522. Call from the phone number on your membership and have your last 4 of SSN, date of birth, full card number, and CVV ready. You’ll choose a new PIN during activation.

- After activation, update any recurring or stored card payments with your new card details.

Traveling in October or November 7–10, 2025? Call us at (419) 586‑5522 to set a temporary mailing address or discuss a reloadable travel card. If you’ve received your new card, bring it and begin using it on or after November 10, 2025. See travel FAQ.

System Upgrade & Temporary Limits (November

7–10, 2025)

The upgrade runs from

Friday,

November

7 at 6:00 PM ET through

Monday, November

10 at 3:00

AM ET. During this time, some services are limited.

Saturday, November

8, 2025: Branches closed for the system upgrade. Online Banking & Mobile App access may be limited during the upgrade window.

How to tell which card is which

| Card Type | Purchases | ATM Withdrawals |

|---|---|---|

| Debit | $1,500/day | $500/day |

| HSA | $1,500/day | — |

| ATM | — | $500/day |

“Purchases” = point‑of‑sale transactions.

About available funds & the “positive balance” file: For Debit, HSA, and ATM cards, daily limits apply only up to your available balance. During the upgrade weekend we send the card networks a positive balance file with your available funds and we will send it as late as possible on Friday, November

7, 2025 so balances are reflected through the weekend. If your available balance is below a daily limit (for example, under

$1,500 for purchases (point‑of‑sale) or $500 for ATM withdrawals), approvals may be limited to the amount available. Additionally, these daily limits reset at

10:00 PM ET each day. Balances continue to update as you use your card over the weekend, so your available amount may change with each transaction please keep track of your purchases/withdrawals so you know what remains available.

| Card Type | Purchases | Cash Advances | ATM Withdrawals |

|---|---|---|---|

| Credit Card | $4,000/day | $3,500/day | $310/day |

About available credit: For Credit Cards, daily limits for purchases, cash advances, and ATM withdrawals apply up to your available credit. We approve the lesser of your available credit or the transaction‑type daily limit ($4,000 purchases, $3,500 cash advances, $310 ATM). These daily limits reset at

10:00 PM ET each day. Available credit continues to update as weekend transactions post; keep an eye on your running balance and consider noting purchases/cash advances so you know what remains available.

Transaction Posting

Transactions made between November 7, 6:00 PM and November 10, 3:00 AM will officially post to your account by 3:00 AM (ET) on November 10. During the upgrade window you may see authorizations pending, but posting will complete after the upgrade.

- Balance visibility: Available/posted balances in Online & Mobile Banking may not refresh until the posting completes at 3:00 AM (ET) on November 10, 2025.

- Alerts timing: Transaction notifications may be delayed during the window and will resume after posting.

- Receipts & backup: Keep receipts or note transactions made during the window to reconcile quickly on November 10, 2025.

- Recurring payments: Merchant-initiated or scheduled payments may authorize during the window and post after 3:00 AM (ET).

- International/offline terminals: Some transactions may authorize offline and post after the window; this is normal.

- Disputes: Dispute/reporting timeframes aren’t affected; if you spot an issue after posting, contact us.

Online Banking & Mobile App

Access suspended during the upgrade window. You will not be able to log in or use Online Banking or the Mobile App between November 7, 6:00 PM (ET) and November 10, 3:00 AM (ET). Access will resume after 3:00 AM (ET) on November 10, 2025.

- Most features unavailable: account and card views, transfers, loan payments, mobile check deposit, card controls, new enrollment, and password resets.

- Plan ahead: Complete time‑sensitive activity before

6:00 PM (ET) on

November

7, 2025.

Key Dates

- By September 30, 2025: Verify your mailing address, phone numbers, and email with us.

- October 2025: Watch your mail for your new cards.

- November 7, 6:00 PM (ET): System upgrade begins; temporary limits in effect; delayed posting; limited Online Banking & Mobile App access.

- November 8, 2025: Credit Union Closed for System Upgrade.

- November 9, 2025: Last day your old debit/credit/HSA cards will work.

- November 10, 2025: Activate your new cards (call (419) 586‑5522) and begin using them.

- November 11, 2025: Credit Union Closed for Holiday.

- 2026: Mobile wallet support planned Apple Pay, Google Pay, Samsung Pay, Garmin Pay, Amazon One.

Frequently Asked Questions

How do I activate my new card and set my PIN?

On or after November 10, 2025, call (419) 586‑5522 and follow the prompts. Call from the phone number on your membership; have your last 4 of SSN, date of birth, full card number, and CVV ready. You’ll choose a new PIN during activation.

Why am I receiving new cards, and will my numbers change?

We’re upgrading to provide new features and security. If you have a Dynamic FCU Debit, Credit, or HSA card, you’ll receive a replacement card for each type you hold with a new card number, expiration date, and CVV. Update card details anywhere they’re stored for recurring or preauthorized payments.

Will my account number change?

No. Your checking, savings, and member numbers remain the same.

Can I keep using my old card until it expires?

It depends on your card type.

- ATM‑only (Marble design): You will not receive a replacement at this time. You can continue using your existing ATM card until its printed expiration date.

- Debit (Sunset design), HSA Debit (Black design), Credit (Silver design): You will receive a replacement card in October. Keep using your current card through November 9, 2025. Begin using the new card on or after November 10, 2025 (activation is not available before that date).

After you activate the new card, remember to update any bills or merchants where your card is on file.

What should I do about recurring or preauthorized payments?

To avoid interruptions, update your payment details with merchants using your new card number and expiration date by November 10, 2025.

I currently have my credit card automatic payment set to pull automatically. What should I do?

Complete Automatic Payment FormIf you use EZCard to make automatic payments to your credit card, you will need to set up autopay again with Dynamic FCU. Please complete our automatic payment form and we’ll configure your autopay to continue after the November 10, 2025 upgrade.

- EZCard autopay ends November 7, 2025. Automatic payment methods set up within EZCard will stop after this date.

- If your payment is currently pulled by Dynamic FCU’s lending team: That automatic payment will continue as normal. We still recommend you contact the lending team to confirm.

- Not sure how your autopay is set up? You can submit the form again. We will apply these changes after November 10, 2025 to create or update your automatic payment.

For context, see New Automatic Payment Enhancement in the What to Expect section.

I didn’t receive my new card by October 30, 2025.what now?

Please call us at (419) 586‑5522 to verify your mailing information and request a replacement if needed.

How to avoid delays

- Keep your contact info current now through November 10: Update your mailing address, phone numbers, and email with the credit union so your card is delivered correctly in October.

- Travel plans (Oct–Nov 10): If you’ll be out of state or away from home any time between October 1 and November 10, call us. We can help with a temporary mailing address for your replacement card or discuss options like a reloadable travel card.

- Watch your mail in October: Your replacement cards are mailed during October. If you haven’t received yours by October 30, contact us.

Will joint owners receive new cards?

Yes. Each cardholder receives their own unique card number. Cards arrive in separate envelopes.

What should I do with my old card after activation?

Continue using your old card until November 9, 2025. After you activate your new card on or after November 10, 2025, securely destroy the old card (cut through the chip and magnetic stripe).

Is the fraud security alert phone number changing?

Yes. Fraud alerts will come from (419) 586‑5522. If you receive a call from this number about potential fraud, you may return the call to confirm.

Are there any fees for the replacement cards?

No. There are no additional fees for your new card. Our existing fee schedule remains in effect after 11/10/2025.

I only have an ATM card. Will I receive a new card?

No. We are not upgrading ATM‑only cards at this time. Your existing ATM card will continue to work after 11/10/2025.

When can I use mobile wallets (Apple Pay, Google Pay, Samsung Pay, Garmin Pay, Amazon One)?

Support for these mobile wallets is planned for 2026. We’ll share updates as we get closer.

What is happening to my existing Credit Platinum Rewards points?

Your current Platinum Rewards points will carry over. We’ll automatically convert your existing balance into Dynamic FCU’s Enhanced Rewards Program when the upgrade goes live.

- No action needed: You don’t need to redeem before the upgrade. Your points will transfer with your account.

- Timing: Details on the new earning and redemption options will be posted here as we approach November 10, 2025.

- After activation: Once you activate your new card on or after November 10, you’ll continue earning rewards under the Enhanced Rewards Program.

More information is coming soon—check back here for the full program guide and FAQs.

I’ll be out of state or away from home during the upgrade.what should I do?

If you expect to be away, please contact us so we can tailor guidance to your situation.

- Traveling during the upgrade (November 7–10, 2025): If you have received your new card, bring it with you and begin using it on or after November 10, 2025.

- Away before go‑live (October 1–November 10, 2025): Call us to arrange a temporary mailing address for your replacement card or to discuss options such as a reloadable travel card.

Also confirm your mailing address, phone numbers, and email are current so we can reach you if needed.

Who can I contact for help?

Call us at (419) 586‑5522 or email info@dynamicfederalcu.com.

Security & Privacy

How we protect you

- EMV chip + contactless security: Each tap/insert uses a one‑time, encrypted code. Contactless only works within about 1–2 inches of the reader.

- 24/7 fraud monitoring: We monitor for unusual activity. Fraud alerts may come from (419) 586‑5522.

- Unauthorized charges: You’re protected when you report them promptly; review your transactions and statements regularly.

What you can do

- Never share sensitive info: We will never ask for your PIN, CVV, one‑time codes, or online banking password by phone, text, or email.

- If something seems off: Don’t click links or call numbers in a suspicious message. Instead, call us at (419) 586‑5522 or the number on your card.

- Use your phone’s protections: Set a device passcode/biometrics and keep your device and the Dynamic FCU app up to date especially ahead of 2026 mobile wallet support (Apple Pay, Google Pay, Samsung Pay, Garmin Pay, Amazon One).

- Prefer tap or chip: Choose tap or chip over swipe when possible. At ATMs and PIN pads, cover the keypad and watch for tampering.

- Turn on alerts: Set up purchase/ATM alerts in Online Banking or the mobile app to be notified quickly of activity.

- Travel plans: If you’ll be out of state in October or November, let us know so we can help you maintain access to your accounts.

If your card is lost or stolen

- Call us immediately: (419) 586‑5522.

- Lock your card: Use card controls in the Dynamic FCU mobile app/online banking (more options coming with the upgrade).

- After replacement: Update cards‑on‑file with merchants and subscriptions.

Privacy

We use your up‑to‑date contact information to deliver your card, send alerts, and reach you about security issues. For details on how we handle your information, please refer to our Privacy Notice.